The foreign exchange market, popularly known as the Forex(FX) market is the largest and most liquid market in the world. Private investors and individual traders have entered the market for global currency and discovering several advantages-many of which are not available in the equities market.

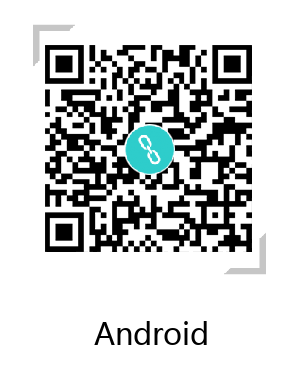

Application Test

- 1. A _________ is equal to 0.01 for exchange rates expressed to two decimal places, or 0.0001 for exchange rates expressed to four decimal places.

- 2. A _________ is used by most forex brokers to close out an open position at the end of the business day, and reopen an identical position as of the next day.

- 3. A carry trade is based on the interest rate differential between two currencies. The idea is to hold _________ the currency with the higher interest rate, while holding _________ a currency with a lower interest rate.

- 4. If you have positive carry, your position _________ money while it is open, but if you have negative carry, you must _________ interest while the position is open.

- 5. "Trading on the technicals" refers to trading based on information derived from _________. This is also known as technical analysis.

- 6. "Trading on the fundamentals" - or "trading the news" - describes traders that attempt to predict the effect _________ such as interest rate changes and labor reports will have on an exchange rate.

- 7. Fundamental analysis is the study of _________ in an attempt to predict future market conditions.

- 8. A _________ order is executed immediately when submitted and is priced at the current spot market rate.

- 9. A _________ order is an order to buy or sell a currency, but only when certain conditions are met. These conditions are in the form of instructions and are attached when the order is first created.

- 10. A limit order that has not yet been executed, is said to be _________.